The Canadian based Fraser Institute released its 2020 Report on the Annual Survey of Mining Companies towards the end of last month. The report shows that Namibia only marginally increased her score on the overall Investment Attractiveness Index and several other jurisdictions performed far better.

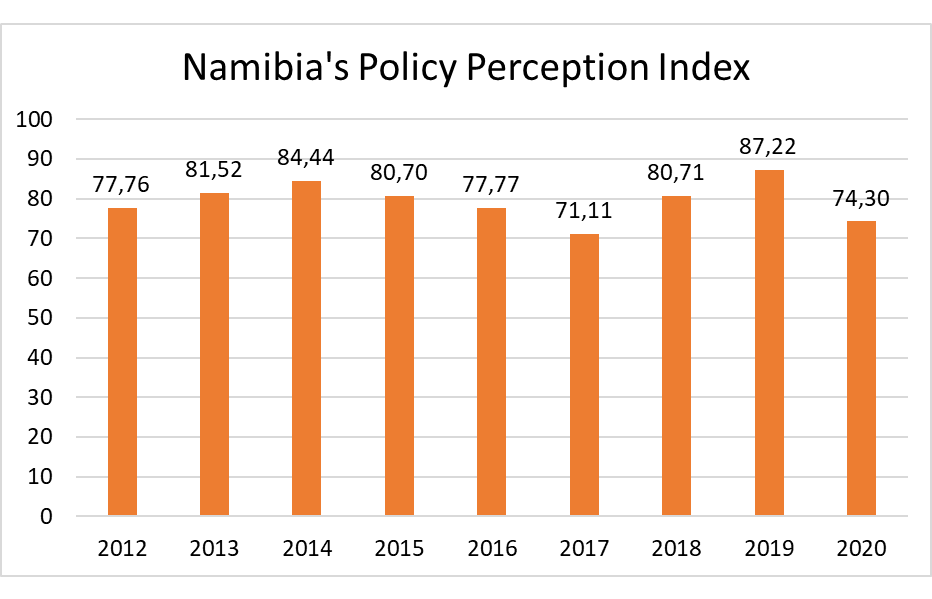

Namibia’s underperformance on the Investment Attractiveness Index was driven by a drastic decline on the Policy Perception Index (PPI) by 12.92 points. The report cites Namibia as the only African jurisdiction that did not improve on this particular index.

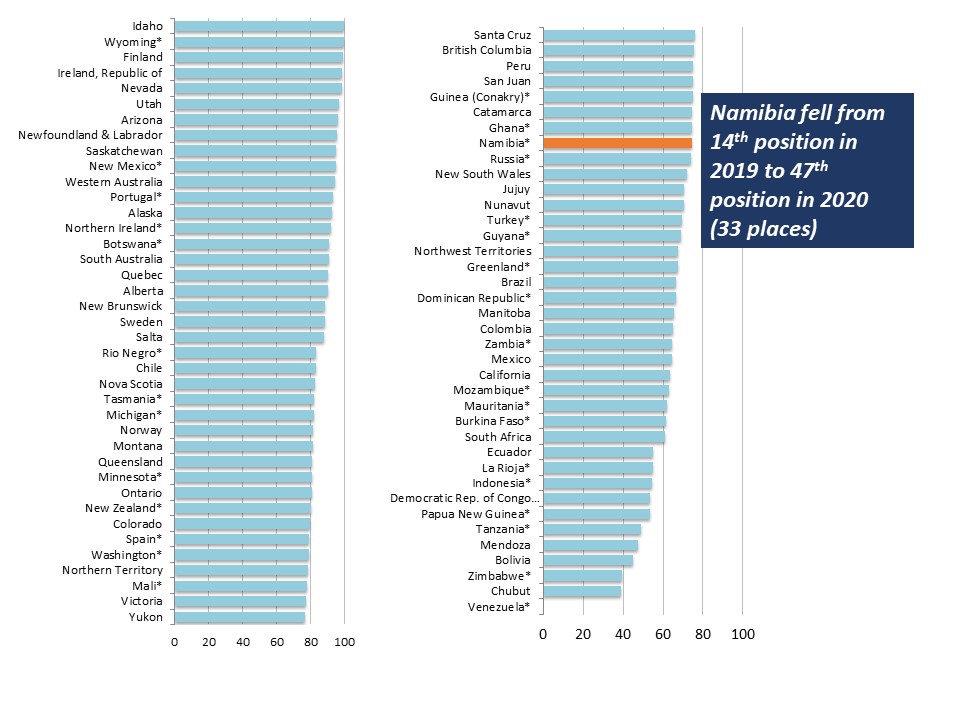

Namibia thus dropped 33 places globally on its PPI score, and fell from first place in 2019 to fifth position in 2020 on the African continent. This is most concerning given that investors regard other jurisdictions as having comparitively more stable and favourable policy frameworks than Namibia.

Namibia’s Global PPI Rankings

Concerns Raised in the Report

Investors expressed concerns over the availability of labour/skills, regulatory duplication and inconsistencies, and infrastructure. Challenges with VAT registrations and input VAT refunds for exploration companies were also cited as hurting Namibia’s competitiveness.

Could Namibia Have Done Better?

These issues dampened the major positive outcome with Government’s pronouncement during 2020 on the complete withdrawal of the non-deductibility tax proposal from the Income Tax Amendment Bill of 2018.

The survey solicited between five and nine responses from Namibia which is not representative of the whole mining industry. Had a higher number of responses been received, the Chamber holds the view that Namibia would have received higher scores on the overall Investment Attractiveness Index and the Policy Perception Index as a result of revoking the non-deductibility tax proposal.

The Chamber of Mines remains committed to working with Government to ensure all outstanding policy obstacles are resolved, and that Namibia once again becomes the most attractive investment destination in Africa, a feat that was achieved in the 2014 Fraser Report.

Calculation and Composition of Investment Attractiveness Index (IAI)

The Investment Attractiveness Index combines the Policy Perception Index and the Best Practices Mineral Potential Index and is an overall measure of a country’s competitiveness.

Namibia’s slight improvement on the Investment Attractiveness Index score is explained by the relative index weightings. The Policy Perception Index carries a weighting of 40% and the Best Practices Mineral Index carries a weighting of 60%.

Although the mineral potential index carries more weight, investors are sensitive to policy uncertainty and will prefer jurisdictions that have a stable policy environment and are conducive to mining.

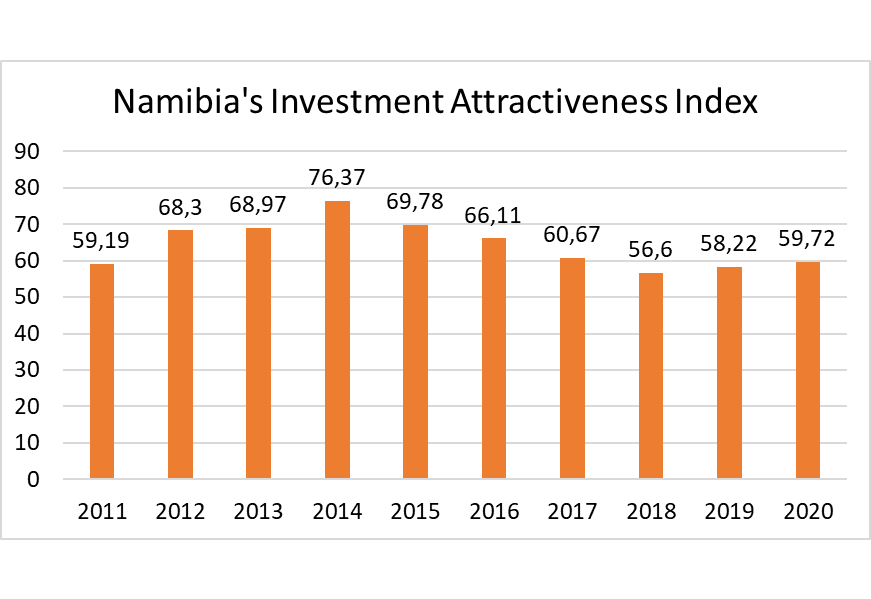

Namibia’s Investment Attractiveness Index

Namibia’s Investment Attractiveness Index (IAI) marginally increased by 1.5 points, from 58.22 in 2019 to 59.72 in 2020.

Namibia’s slightly higher score on the IAI in 2020 is due to the significant increase recorded in the Best Practices Mineral Potential Index, which was offset by a substantial drop in the Policy Perception Index.

Namibia’s Policy Perception Index

The Policy Perception Index (PPI) measures the opinions of survey respondents on all facets of the policy environment, such as taxation and regulation certainty. Namibia’s PPI fell 12.92 points from 87.22 in 2019 to 74.30 in 2020.

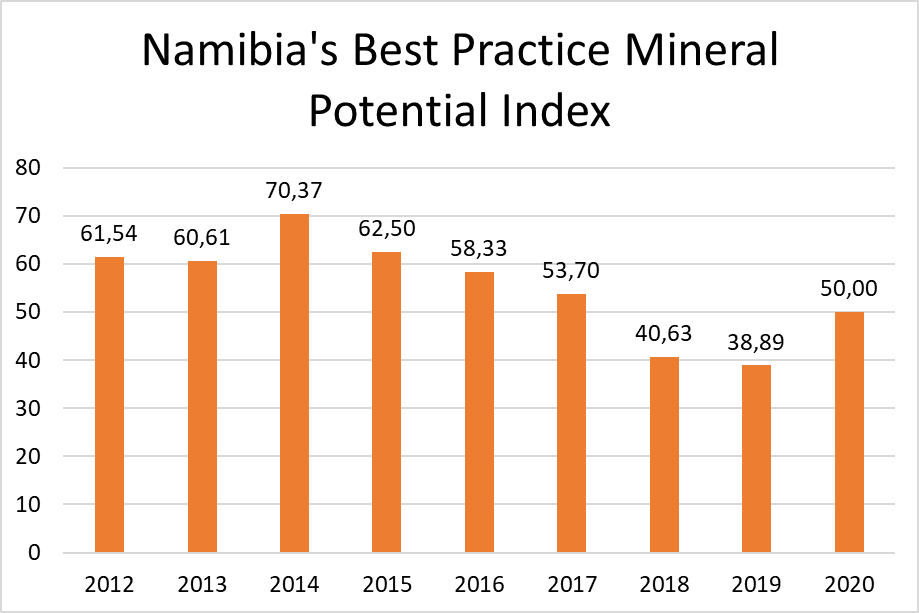

Namibia’s Best Practices Mineral Potential Index

The marginal improvement of Namibia’s overall investment attractiveness was due to a higher score on the Best Practices Mineral Potential index. This index measures perceptions of a country’s mineral potential, assuming a world class regulatory environment. Namibia achieved a score of 50 in 2020 compared to a score of 38.89 in 2019.